Cyber threats are no longer just an IT problem. They’re a pressing concern for financial institutions as well. As keepers of some of the most sensitive and valuable data, banks and financial firms are prime targets for increasingly sophisticated cybercriminals. Every transaction, every client record, and every moment of downtime is a potential risk. The stakes couldn’t be higher. Let’s dive into the biggest cybersecurity challenges facing the financial sector and how to tackle them head-on.

Why Financial Services Are a Prime Target

It’s simple: cybercriminals follow the money. And in the digital age, financial data is as good as gold. Banks, wealth managers, and investment firms house a treasure trove of sensitive client information—account numbers, transaction histories, personal details like social security numbers—the kind of data that can be exploited for identity theft, fraud, and beyond. Here’s why today financial institutions find themselves in the crosshairs:

High Value of Data: Financial data is a jackpot for hackers. On the black market, a single stolen financial record can fetch a hefty price. The more detailed the data, the higher the payout.

Sophistication of Attacks: Cyber criminals targeting the financial sector are no amateurs. They’re using cutting-edge techniques to bypass even the most robust security measures.

Potential for Disruption: A ransomware attack or breach that takes down financial systems impacts more than just a company’s reputation. It can completely halt operations. This downtime often pressures organizations to pay ransoms to restore functionality as quickly as possible.

The Biggest Cybersecurity Threats to Financial Data

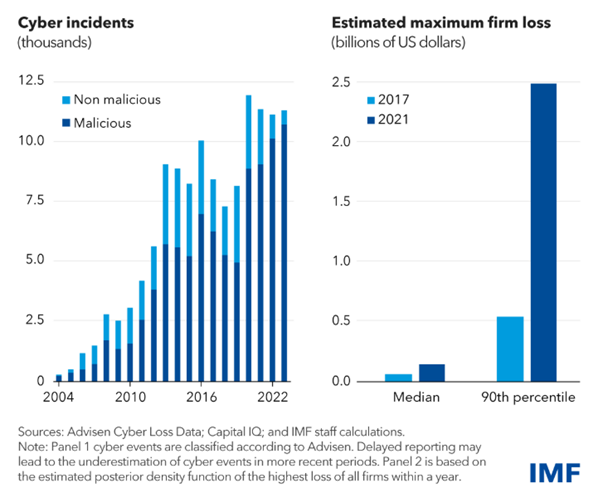

According to an IBM study, the global average cost of a data breach in 2024 is $4.88 million—a 10% increase over last year and the highest total ever, and 75% of the increase in average breach costs in this year’s study was due to the cost of lost business and post-breach response activities [i]. The International Monetary Fund (IMF) states that financial institutions are prime targets for cybercriminals aiming to steal funds or disrupt economic operations. Nearly 20% of all attacks are directed at financial organizations, with banks being the most heavily affected.

To understand how to protect financial institutions, it’s essential to recognize who their adversaries are. Here are the top threats that worry cybersecurity teams:

1. Phishing Scams

Phishing is the oldest trick in the hacker’s book, and it’s not going anywhere. Financial firms are prime targets for phishing attacks that disguise malicious intent under the guise of official emails or messages. A single click can open the floodgates, granting cybercriminals unauthorized access to critical systems and sensitive data. The financial repercussions? Potentially devastating!

2. Ransomware Attacks

Ransomware attacks have become more common and sophisticated in recent years. In a ransomware attack, cybercriminals install malicious software on a system that encrypts files or locks users out of critical systems. They then demand a ransom for the data’s release. For financial firms, ransomware can be devastating, leading to lost time, data, and significant financial costs. Additionally, institutions that handle money directly are often considered “high value” targets, increasing the likelihood of such attacks.

3. Insider Threats

Insider threats can be just as dangerous as external ones. These breaches are caused by individuals within the organization, including employees, contractors, or partners. These breaches can be intentional or accidental; employees with access to sensitive information may unwittingly create vulnerabilities by clicking a malicious link or downloading unauthorized software. Intentional breaches by disgruntled employees or contractors can be even more damaging. Insiders may have privileged access to financial data, making their actions difficult to detect.

Building a Fortress: Essential Cybersecurity Strategies

Thankfully, financial institutions aren’t defenseless. By adopting proactive measures, they can significantly reduce their exposure to cyber risks. Here are some non-negotiables for staying ahead of the curve:

Multi-Factor Authentication (MFA)

“Passwords alone won’t cut it anymore,” says Brian McCarthy, President of Open Tier Systems. “Multi-factor authentication is not longer optional, it’s essential for safeguarding access to critical systems.” MFA is a technique that adds an extra layer of security by requiring users to verify their identity with something they know (like a password), something they have (like a smartphone app), and something they are (like facial or fingerprint recognition). It’s simple, effective, and essential for keeping unauthorized users out, and is often a required component of regulatory compliance.

Continuous Network Monitoring

Cyberattacks can escalate within seconds, and that’s why early detection is crucial. Advanced tools allow organizations to continuously analyze system activity, minimizing the risk of data breaches or service disruptions. By identifying unusual behaviors, such as sudden data transfers or unauthorized logins, financial institutions can neutralize threats before they escalate out of control.

Employee Training and Awareness

Employees are often the first line of defense in cybersecurity, and they play a crucial role in keeping systems secure. Regular training programs can help employees recognize phishing scams, understand data security best practices, and respond appropriately in the event of a cyber incident. By equipping employees with the knowledge to recognize and report threats, financial firms can significantly reduce their exposure to cyber risks.

Partnering with Open Tier Systems for Enhanced Cybersecurity

Navigating the complex world of cybersecurity can be daunting, but you don’t have to do it alone. Open Tier Systems specializes in providing tailored cybersecurity solutions designed specifically for the financial sector. We understand the unique challenges and regulatory requirements you face and offer a proactive approach to keeping your systems and data secure.

How We Can Help

- Customized Security Solutions: From advanced endpoint protection to industry-specific threat detection, we design solutions that fit your institution’s unique needs, ensuring the safety of sensitive data and providing peace of mind.

- Proactive Threat Management: Our continuous monitoring and rapid response capabilities ensure that potential threats are neutralized before they cause harm. By leveraging industry-leading tools and techniques, we help financial firms maintain a secure and compliant IT environment.

- Employee Training Programs: We don’t just secure your systems; we understand that employees are a critical component of cybersecurity. That’s why Open Tier Systems provides ongoing training programs to educate staff on best practices, helping to build a culture of security awareness within your organization.

- Incident Response and Disaster Recovery: In the event of a security breach, every second counts. Our experienced team works swiftly to identify the root cause of an attack, mitigate the damage, and put measures in place to quickly restore your systems and prevent future incidents.

Ready to Strengthen Your Defenses?

Cybersecurity isn’t a one-time effort—it’s an ongoing battle. With the right strategies and the right partner, you can stay one step ahead of cybercriminals. At Open Tier Systems, we’re committed to helping financial institutions like yours protect what matters most. “Cybersecurity isn’t just a technical issue; it’s a strategic one. Our mission is to simplify the complexity of digital security so our clients can focus on what they do best,” adds Mr. McCarthy.

Let’s build a safer digital future together. Contact us today to get started.

[i] https://www.ibm.com/reports/data-breach